Establish & Grow Passive Income & Wealth Creation

Through Real Estate and Private Equity

Structured Cashflow

Our EPIC Model is designed with wealth creation at its core. Enjoy the benefits of equity upside or steady cash flow while we handle the details.

The Right Investments

Build recession-resistant, sustainable passive income by investing in diverse real estate opportunities in high-growth markets.

Generate Passive Income

Let your money work for you with a portfolio of value creation through development and long-term income-generating assets that deliver returns—without the need for active involvement.

A Legacy That Matters

Focus on income and upside to protect your retirement fund, build generational wealth, and secure a lasting legacy without the stress of active management.

About Epic Capital Funds

Epic Capital is dedicated to helping families and individuals grow their wealth through strategic real estate investing. Our experienced team focuses on high-value commercial, residential, industrial, and land assets, managing the complexities of the market so you don't have to. With a proven track record of delivering targeted returns, Epic Capital is here to strengthen your portfolio and secure your financial future—all while you sit back and enjoy the benefits.

Debt Investments

Epic Capital Funds provides a hassle-free investment strategy to generate passive income by lending money to reliable borrowers and providing debt financing to our strategic partners for real estate projects. We handle everything—from identifying and vetting borrowers and projects to negotiating loan terms, monitoring progress, and addressing any issues during the loan term. Our approach offers a secure and profitable way to enjoy a steady stream of passive income supported by real estate, without the need for active management.

Building Equity

At Epic Capital Funds, we recognize the value of equity in real estate projects. Equity provides the necessary capital to complete projects and maintain cash reserves, offering flexibility and strong potential returns. As an equity investor, you benefit from our expertise in managing businesses and navigating market cycles, with our team negotiating favorable terms and providing ongoing support throughout the investment process. Enjoy the rewards of equity investing to produce passive income over time without the need for active involvement.

Recently Funded Projects

We acquire commercial, residential, industrial, and land assets and increase their value through development, construction, operations, and improvements. We cultivate projects in selected communities primarily throughout Boise and Treasure Valley, but we also serve the Utah and Nevada markets. Our definition of success is when we deliver targeted returns to you that strengthen your portfolio and enrich the areas in which you invest.

$1,000,000

Epic Capital Co-GP Fund I

Schedule of Projects:

First Project: Three Thirty Six Apartments (Salt Lake City, UT)Second Project: Peoria Commons Apartments (Peoria, AZ)

Third Project: Avondale Commons Apartments (Avondale, AZ)

Fourth Project: The Falls at Crismon Commons (Mesa, AZ)

Offering Size: $1,000,000

Length: 10 years

Target IRR: 21%

$1,500,000

Saltese Creek Mixed-Use Co-GP

- Mixed-use development with 195 apartments, up to 80 finished SFR lots in Phase 1

- 128 Apartments to be added in Phase 2

- Backed by Hawkins Company

- Preferred Equity up to 75% LTC

Offering Size: $1,500,000

Length: 48 Months

Target IRR: 23%

$3,600,000

Helix 144 Apartments

- 5.25 Acres Free and Clear

- Development of 144 Apartments

- Located in the Innovation submarket of Richland, WA

- Permits Approved

- Amenities include a clubhouse, fitness center, and pool

Offering Size: $3,600,000

Length: 36 Months

Target IRR: 21.3%

$5,000,000

Flats 16

- 94 Lots, 59 Detached SFR, 35 Townhomes

- The location fronts the River Birch Golf Course on two sides

- Numerous amenities, including a dog park, pickleball court, and walking paths

- Attainable home prices with an Eagle, Idaho address

Offering Size: $5,000,000

Length: 48 Months

Target IRR: 24.1%

Recently Funded Projects

We acquire and enhance commercial, residential, industrial, and land assets through strategic development, construction, operations, and improvements. Our projects are primarily in Boise and Treasure Valley, with additional opportunities in Utah, Nevada, and Washington. Our success is measured by delivering targeted returns that strengthen your portfolio and enrich the communities where you invest.

$798,000

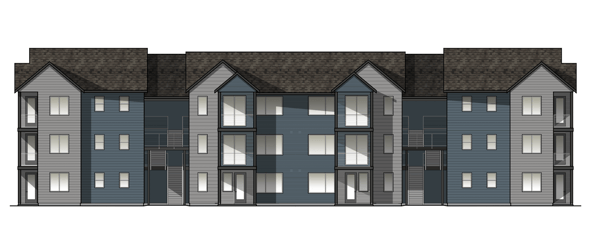

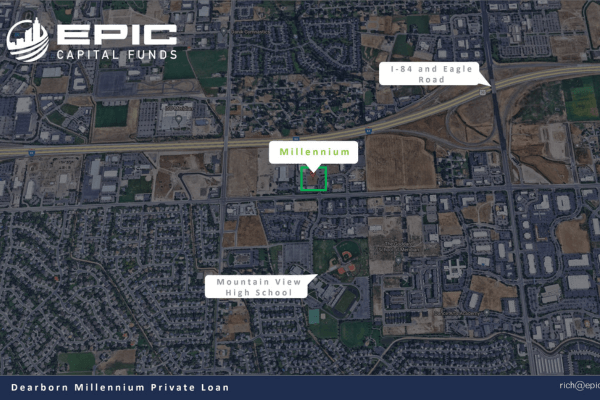

Dearborn Millennium Private Loan

- Secured by First Deed of Trust

- Excellent locations within city limits

- Zoned and approved commercial

- Strong borrower history

- Dearborn is permit ready

Offering Size: $798,000

Length: 36 Months

Fixed Rate: 12%

$2,561,600

Virginia Industrial Development

We are pleased to announce the successful acquisition of Reno Industrial and the completion of the first phase of our joint venture project with Mohr Capital. Mohr submitted a PSA to purchase the land from us in October for a net gain of $450,000, which will be shared 50/50 with investors.

Offering Size: $2,561,600

Length: 4 Months

Target IRR: 31%

$2,750,000

27th Street Crossing Private Loan

- Mixed-use development with 65 multifamily units and 6,400 SF of Commercial Space on Ground Floor

- Significant demand with a current waitlist of tenants

- Construction completion target Q3 2023

Offering Size: $2,750,000

Length: 24 Months

First Year: 12%

Second Year: 13%

$2,860,000

Warm Springs Townhomes

- Build to sell model development

- 33 Single Family Townhomes

- Direct foothills access

- Easy access to downtown

- Across from the Boise River

- 4.5 miles to Micron

- Estimated project completion by the end of 2025

Offering Size: $2,860,000

Length: 36 Months

Target IRR: 22%

$4,025,000

Coffey Townhomes on Chinden

- Project flexible as build-to-sell or rent, based on market demand

- 76 Two Story Townhomes

- Easy access to downtown Boise

- Near public transportation

- Less than one mile from the Boise River

- Estimated project completion by end of 2025

Offering Size: $4,025,000

Length: 36 Months

Target IRR: 24%

$10,800,000

Saltese Creek Mixed-Use

- Mixed-use development with 195 apartments, up to 80 finished SFR lots in Phase 1

- 128 Apartments to be added in Phase 2

- Backed by Hawkins Company

- Preferred Equity up to 75% LTC

CoGP Offering Size: $1,500,000

Length: 48 Months

Target IRR: 23%

“The team provided invaluable advice and assistance; I got such a personal service that I just haven’t got from other firms, saving me time and, most importantly, money”

Mark ThornManaging Director

“The team provided invaluable advice and assistance; I got such a personal service that I just haven’t got from other firms, saving me time and, most importantly, money”

Mark ThornManaging Director

Our Preferred Partners